What’s Up with Real Estate? - Feb 2024

National Real Estate News

Real Estate Transactions on the Rise In January, existing home sales surged by 3% month-over-month, totaling 4 million units on an annualized basis, marking the highest level since August 2023, according to the National Association of Realtors (NAR). This recovery trend is attributed to several factors: 1) the impact of lower mortgage rates experienced in November and December 2023, 2) a slight improvement in inventory levels, and 3) typical seasonal patterns. The median nationwide sales price in January reached $379,000, reflecting a 5% increase compared to the previous year.

Cash Transactions Gain Momentum Amid affordability concerns, the proportion of all-cash transactions in January 2024 climbed to 32%, a figure not seen since 2014. Who are the players behind these cash deals? Primarily, older homeowners leverage substantial equity from their existing properties and seasoned property investors. However, first-time buyers still accounted for 28% of sales, underscoring their determination to secure housing despite financial challenges. As the saying goes, when the need to move arises, action follows.

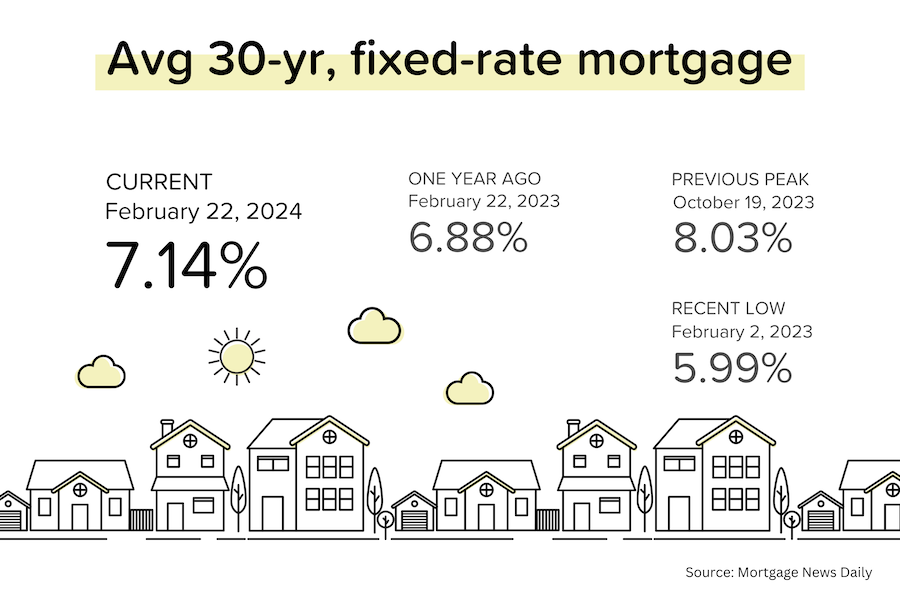

Rising Mortgage Rates Recent weeks have witnessed a notable uptick in average mortgage rates, surpassing the 7% threshold for the first time in several months. This week, rates continued to climb, prompted by the Federal Reserve's meeting notes signaling a consensus among members favoring a "higher for longer" stance on interest rates. Bolstering this position are recent reports indicating higher-than-expected Consumer Price Index (CPI) readings and robust job market figures, as indicated by the Federal Reserve and the Chicago Mercantile Exchange (CME).

Categories

Recent Posts